Contents:

Any transaction posted in your ledger or your accounting software will be a debit or a credit. There is a lot of variety out there when it comes to choosing accounting software. We suggest you start by thinking about your business goals and look for software that can help you meet those goals. Try to find something that is relatively flexible so as your business grows and changes your software can change with it. We recommend you pick software that is no more than 25% of your bookkeeping and accounting budget. How you record your financial information is really up to what works best for you and your business.

3 Accounting Methods You Need To Know In 2023 – Forbes

3 Accounting Methods You Need To Know In 2023.

Posted: Tue, 24 Jan 2023 08:00:00 GMT [source]

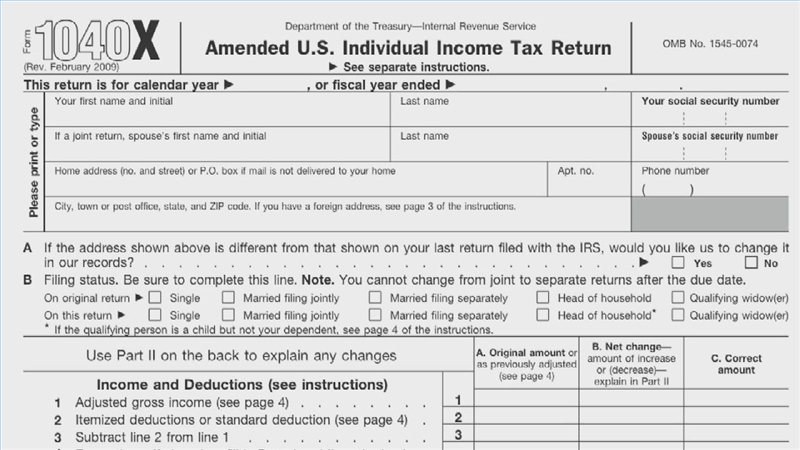

Take the simple step of setting yourself a reminder so that you have enough time well beforehand to fill out your tax returns without any mistakes. By keeping accurate records, you can make sure your returns are sent off by the deadline and HMRC won’t be chasing you up because of any errors either. If you’re doing your books manually, then it’s vital that you leave an audit trail. Rather than facing a major surprise when the taxman comes knocking, it’s a good idea that you budget for tax as you go along so you don’t have to pay a big chunk at once. Revenue is all of the money you collect in the process of selling your services and goods.

Step 4: Close the month and run financial statements

You need to go back to the outstanding checks and journal entries and check through them for errors. The downside of accrual accounting is that it makes it hard for businesses to know what cash is currently available to spend. A debit does not always mean the flow of cash out of the business, likewise, a credit does not only refer to money earned. The account type determines whether a transaction credits or debits that account. Debits and credits are recorded as journal entries in the ledger.

Finally, students learn briefly about the transition from a manual to a computerized bookkeeping system. The first method of accounting is the cash-based accounting method. This method records financial transactions when money is exchanged. This means that you don’t record an invoice until it is actually paid.

However, if you don’t have a lot of bookkeeping experience (or don’t have time to learn), they could stress you out more than they help you. Especially if your accountant ends up telling you you’ve been using them incorrectly for the past year. There’s nothing worse than having to search through too many statements to find one small yet vital piece of financial business that you need. That can often be the case if you haven’t split your personal and business funds, so they’re always combining into one account and it’s easy to lose track. A balance sheet is a detailed report which breaks down the financial situation of your business.

Take your learning further

However, for bookkeeping, it is beneficial for businesses to spend on it than not to. Bookkeeping mistakes are costly and can negatively impact your business success. Accounting and bookkeeping should not just be about the now, it should also help small businesses to anticipate future business’s financial trajectory. Compiling a monthly financial report is not very useful if you cannot use it to make informed decisions about the future. Some of these future outlooks include tax payments, projected income, and others. As a business owner, you have no business learning about the latest accounting terminology or crapping 100s of accounting terms in your head.

Robin Buckallew Debuts Bookkeeper Training Program Focused on … – Digital Journal

Robin Buckallew Debuts Bookkeeper Training Program Focused on ….

Posted: Mon, 04 Jul 2022 07:00:00 GMT [source]

More than likely, someone within your small-business community will be able to point you in the right direction for getting the best bookkeeping assistance for your business. Enters every transaction twice, as both a debit and a credit, to “balance the books” between accounts. Although more complicated, it can prevent errors in recording transactions. Records all of your transactions once, either as an expense or an income. This method is straightforward and suitable for smaller businesses that don’t have significant inventory or equipment involved in their finances. That said, the above-mentioned bookkeeping basics will be enough to get you started, helping you record your business’s transactions with peace of mind.

The importance of bookkeeping.

Recording and maintaining an accurate sales account will help you understand where your business is currently standing. This account tracks the purchase of any raw materials and finished products for the business. This account is a crucial component when it comes to calculating the cost of goods sold — indispensable if you run an online or brick-and-mortar store. You just subtract the amount you paid to buy the raw material from the sales, and the remainder is your profit. This account tracks the amount you into your business as its owner, minus any liabilities.

The balance sheet is a financial document used by bookkeepers and accountants to summarize your business’s assets, liabilities, and equity at a given period. In the balance sheet, your total assets must be equal to the sum of all liabilities and equity accounts else the balance sheet is not balanced. Luckily, the double-entry system ensures that businesses get their figures right. By recording transactions in two columns, the records must match for you to close the books. A mismatch in the debit and credit entry means that your account is inaccurate and you cannot close your books until you rectify it.

You need to know your net profit in order to do your taxes, and to figure that out, you need to know your total income and expenses. And the only way to know that for sure is to have accurate, up-to-date books. Don’t have an accounting degree or a bookkeeping qualification? Here are the basic concepts you can learn to get started right away to do the books like a pro. A digital app lets you keep your incomings, outgoings and everything in between properly organised which makes it simpler to manage your financial records. Late-paying customers is never a good thing and it can have a negative impact on your cash flow.

There is absolutely nothing wrong with that approach, however, using your account to run your business can bring about lots of issues. If you have employees working with your small business, let them know how important it is to save receipts and itemize them. Create a centralized system through which they have to record all receipts and itemize all expenses. Here are some of the best accounting tips to small business owners which you should utilize to avoid those common accounting mistakes that can affect your business negatively.

The accounting software for small businesses has an intuitive interface and an easy learning curve. Wave is free accounting software that is perfect for small businesses with a small budget. Although its features are limited , it still provides lots of amazing bookkeeping features such as invoice and expense tracking.

The software has an advanced transaction tool that classifies all your transactions according to category, date, description, and amount. Through its checkmark tool, you can verify the accuracy or completeness of your transactions. If you elect to postpone it till the end of the day when you are closing the shop, there is a tendency for you to make mistakes and dread the tasks. If you want to figure out profit and loss, use this simple formula. Validating the accuracy of your financial data will prevent confusion and any legal issues down the road.

- When manually doing the bookkeeping, debits are found on the left side of the ledger, and credits are found on the right side.

- His book became the teaching tool for bookkeeping and accounting for the next several hundred years.

- Later, you use these summaries to answer specific financial questions about your business, such as whether you’re making a profit and, if so, how much.

- The best accounting software automates a lot of the process in journal entries for regular debits and credits to help eliminate possible errors in data entry.

- Small businesses can use bookkeeping to improve their profitability by identifying areas of their business operations with massive profit potentials.

If you’ve accurately kept track of and reported your employees’ salaries and wages, you can claim them with the Employee Retention Credit. With this credit, you can get up to $26,000 back per employee during COVID-19. Double-entry is more complex, but also more robust, and more suitable for established businesses that are past the hobby stage.

- Before selecting software to invest in, consider your business goals.

- Organizing your banking is crucial for businesses to ensure they always stay on top of their finances.

- Owners of the business have claims against the remaining assets .

You can also use apps like Shoeboxed, which are specifically made for receipt tracking. Every transaction you make needs to be categorized and entered into your books. Keeping an accurate, up-to-date set of books is the best way to keep track of tax deductions . That’s why we’ve created a handy checklist so you can do bookkeeping like a pro.